PKS market gears up for Japanese sustainability requirements

by

Rachael Levinson

Jun 16, 2021

Japanese biomass market participants are urging palm kernel shell (PKS) suppliers to start preparations early for new Japanese sustainability requirements. In late May, conference organiser CMT gathered stakeholders online for a virtual conference to discuss the new PKS sustainability requirements. From April 2023 Japan’s Ministry of Economy, Trade and Industry (METI) will introduce mandatory sustainability requirements for PKS used under the Feed-in-Tariff subsidy scheme. The PKS supply chain must have third party certification starting at the crude palm oil (CPO) mill to prove compliance with the requirements. This means the sustainability of oil palm cultivation is not taken into consideration.

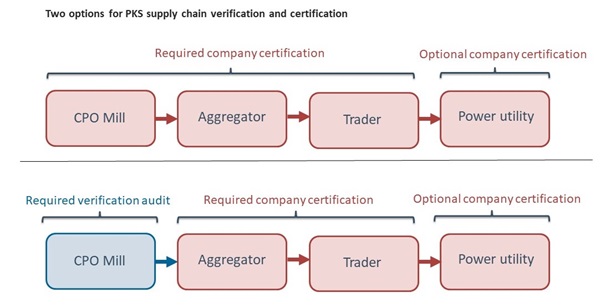

There are two routes for palm oil mills to provide PKS into a certified supply chain; either through obtaining third party certification or carrying out an audit against the sustainability criteria set out by METI (known as a principle and criteria audit). PKS aggregators can carry out the verification audit on their sourcing CPO mills, which is then checked by a certification body. Three certification schemes have been approved so far; RSB, RSPO and GGL. But since RSPO does not include chain of custody, only RSB and GGL can be used to certify the entire supply chain.

METI will consider accepting other certification schemes including ISCC, ISPO and MSPO if they make amendments to their schemes. Sourcing certified PKS would likely be much easier if schemes like ISPO and MSPO were accepted. Uptake of MSPO by CPO mills in Malaysia is high, as is ISPO in Indonesia. However, there is more work to do if ISPO and MSPO are to meet the government’s requirements.

Currently very few PKS producers and traders have the required sustainability certification. Trading company Hanwa estimates around 10% of Japanese PKS traders have achieved certification, with many more starting the process to become certified. From our own conversations with PKS suppliers, it is the smaller aggregators which seem the least prepared. In contrast the larger aggregators and traders such as Hanwa (which supplied 800kt of PKS to Japan in 2020) understand the need to start preparations early. Hanwa has already achieved GGL and RSB certification. The cost associated with getting the supply chain certified could be prohibitive to smaller suppliers.

However, in just the last year, the importance of the Japanese market to PKS suppliers has prompted more traders and suppliers to consider sustainability certification. In 2020, Japan accounted for over 80% of PKS exported from Malaysia and Indonesia, totalling 2.2Mt. And we expect Japanese PKS demand to grow to 4.6Mt/y by 2024, boosted by the start-up of new projects.

Power producer Erex is leading the way in certifying its PKS supply chain and was the first power plant to achieve GGL certification in Japan. Power plants are not obligated to achieve certification under METI’s rules but traders must. Erex achieved GGL certification for its trading arms and Saiki power plant in 2020. It also supported the certification of its affiliated company Straits Green Energy which acts as an aggregator of PKS. It now aims to verify the CPO mills it sources PKS from under the principal and criteria audit and plans to begin shipping GGL-certified PKS by the end of 2021.

The PKS market still has a long way to go to certify enough of its supply chain to meet Japanese demand from 2023. It is important suppliers understand the necessity to get certified ahead of the 2023 date. Hanwa estimates it takes around 6-8 months for PKS suppliers to achieve certification. The time will vary depending on the structure of the supply chain e.g. whether PKS is sourced from multiple mills or is handled by several aggregators/collectors. There is also a limited number of auditors in the region which may slow down the process.

There is speculation that if not enough supply is certified the FOB price of PKS may rise ahead of April 2023. Many end-users in Japan do not have the flexibility to switch to other biomass. For example those without covered storage or suitable handling equipment will not be able to use wood pellets. However prices should stabilise as suppliers achieve certification and more certified PKS is made available to the market.

To find out more about expected PKS demand in Japan and the new sustainability requirements please get in touch to learn about our latest Biomass Demand in Japan and South Korea report.